Copyright © | Hardin County KY PVA

Tax Rates

Rates set and provided by individual taxing jurisdictions. Not responsible for accuracy or computation of tax amounts.

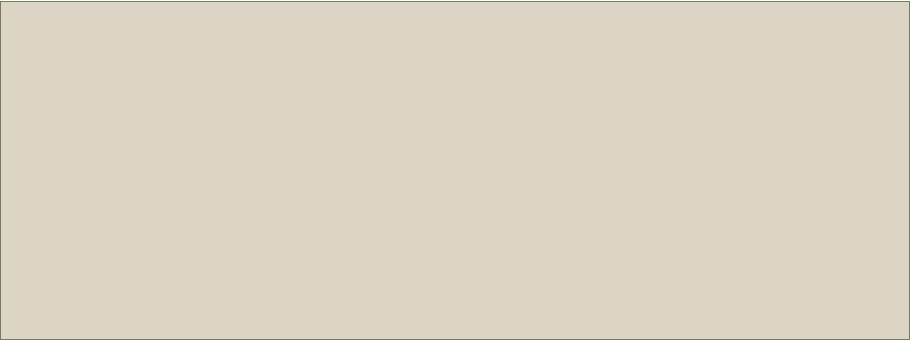

Hardin County

2024 Real Estate Tax Rate Schedule

Tax District

State Rate

School Rate

County Rate

Ag Ext Rate

Health Rate

Soil Rate

Total Rate

Hardin County School

10.90

65.20

11.10

1.800

2.20

.2

91.35

E-town Ind. School (07)

10.90

84.50

11.10

1.800

2.20

.2

110.65

Hardin County School

E-town Ind. School (07)

Hardin County

2024 Tangible Tax Rate Schedule

Cars & Boats

Tangibles

Inventory

Cars & Boats

Tangibles

Inventory

45.00

45.00

5.00

45.00

45.00

5.00

54.00

65.20

65.20

53.80

84.50

84.50

11.50

11.10

11.10

11.50

11.10

11.10

1.46

2.45

2.45

1.46

2.45

2.45

2.20

2.20

2.20

2.20

2.20

2.20

114.16

125.95

85.95

113.96

145.25

105.25

Tax District

Property Type State Rate

School Rate

County Rate

Ag Ext Rate

Health Rate Total Rate

* Included on County Tax Bill

HOMESTEAD/DISABILITY EX 2023/24 - $46,350

HOMESTEAD/DISABILITY EX 2021/22 - $40,500

Fire Acres: Timberland Fire Protection 2 cents per acre

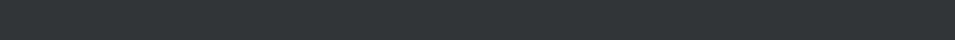

Hardin County

2024 City Tax Rate Schedule

City

Real Estate, Tangible, & Inventory Rate

Car & Boat Rate

E-town

(02-07)

11.0*

11.6

Radcliff

(03)

Real Estate

12.9

Personal 17.0

19.9

Sonora

(04)

20.00*

20.0

Upton

(05)

25.00*

25.0

Vine Grove (06)

Real Estate

16.3

Personal 34.98

25.08

West Point (09)

Real Estate

30.0*

Personal 29.0

40.7

Ordinance No. 337 Series 2023: Industrial Taxing District (District 00) - Commercial property and Telecommunication property addtional rate of ten

cents per $100 of assessed valuation